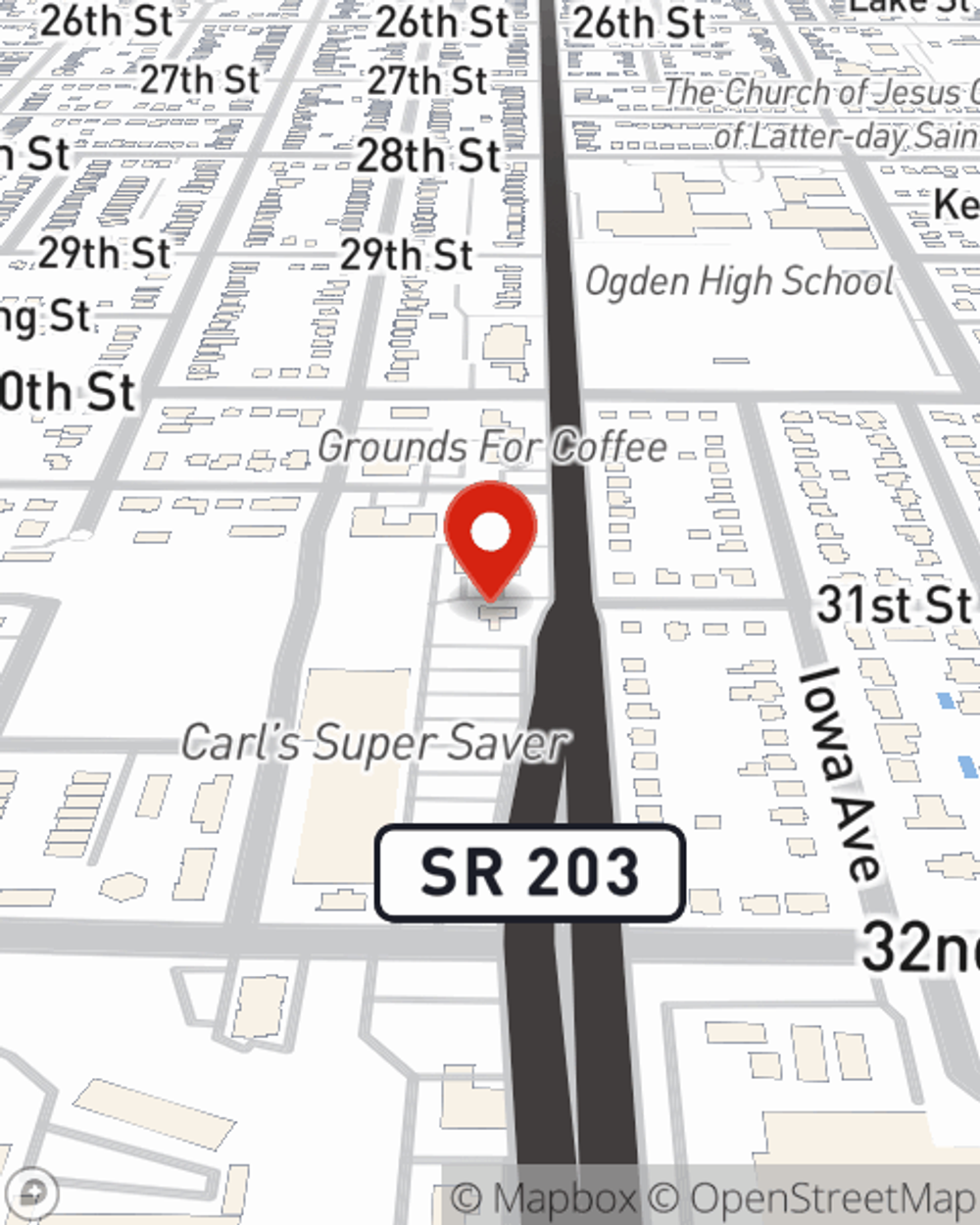

Business Insurance in and around Ogden

Get your Ogden business covered, right here!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to keep track of. We understand. State Farm agent Ralph Dunkley is a business owner, too. Let Ralph Dunkley help you make sure that your business is properly covered. You won't regret it!

Get your Ogden business covered, right here!

Helping insure small businesses since 1935

Insurance Designed For Small Business

If you're looking for a business policy that can help cover accounts receivable, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

It's time to call or email State Farm agent Ralph Dunkley. You'll quickly discern why State Farm is the reliable name for small business insurance.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Ralph Dunkley

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?